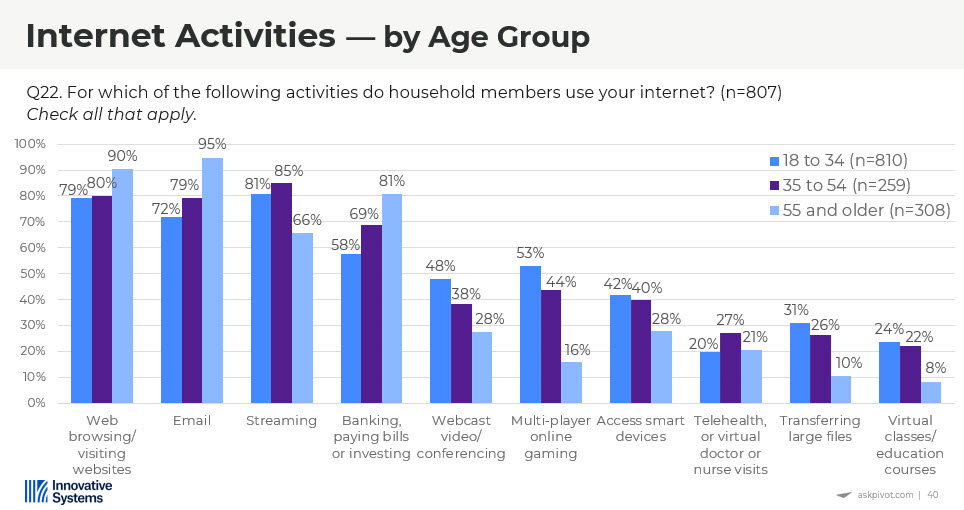

According to the 2015 Rural Subscriber Study, a significant number of rural Americans over the age of 55 are now paying their bills and banking online. While this is a positive development that indicates technology is bridging the generational gap, there are also concerns about their vulnerability to cybercriminals.

According to the Federal Reserve’s Survey of Consumer Finances, this demographic has an average net worth of $1.6 million. The cyber criminals understand this, so it is crucial for service providers to take every possible measure to protect individuals from financial exploitation online.

Telemarketers Also Taking Advantage

According to the Federal Trade Commission, American consumers lost $280 million due to illegal robocalls, telemarketers, and other scammers. This amount represents over a quarter of a billion dollars for just the first quarter of this year.

How Can You Help as a Service Provider?

In cybersecurity, regular education about how digital criminals attempt to access sensitive information is essential. What’s interesting is that most scams are not new; however, without regular reminders, people tend to let their guard down. It only takes one careless click and the entry of sensitive information for a person’s financial and personal safety to be compromised, and in some cases, ruined permanently.

Telephone security can be trickier, as criminals can gain live access to unsuspecting ones and use persuasive arguments to gain that person’s trust and access to their bank accounts. For many years, Innovative Systems has offered the most effective solution: the TCM Call Screener. TCM intercepts landline calls before they ring, delivering a challenge message that basic autodialers cannot comprehend, causing the call to drop.